CircleBlack’s Wealthcare Integration Reduces Advisor Burden while Enhancing Client Understanding and Spurring Action

CircleBlack integrates with best-in-class technology solutions, Wealthcare from Financeware, to provivde Wealthcare’s Comfort Zone Score. This tool flows seamlessly into CircleBlack’s Investor Dashboard, providing wealth advisors with sophisticated, yet user-friendly tools to manage and present financial data.

What Is Wealthcare’s Comfort Zone Score?

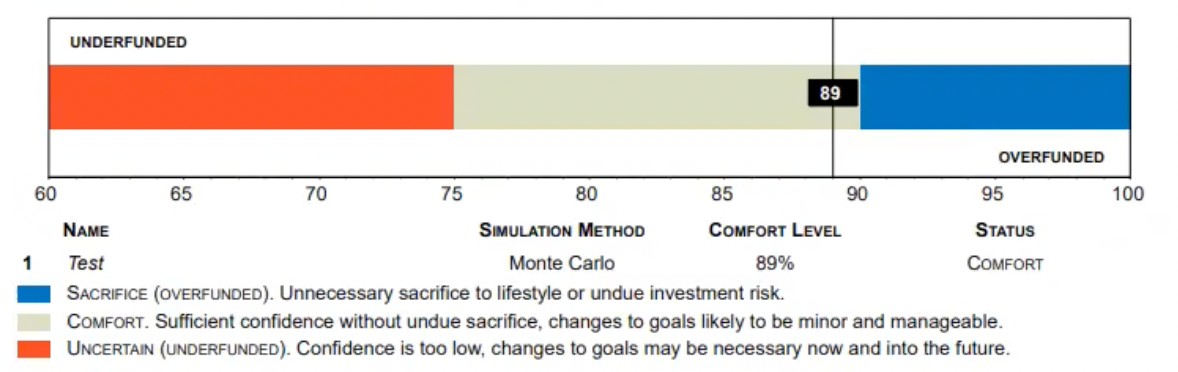

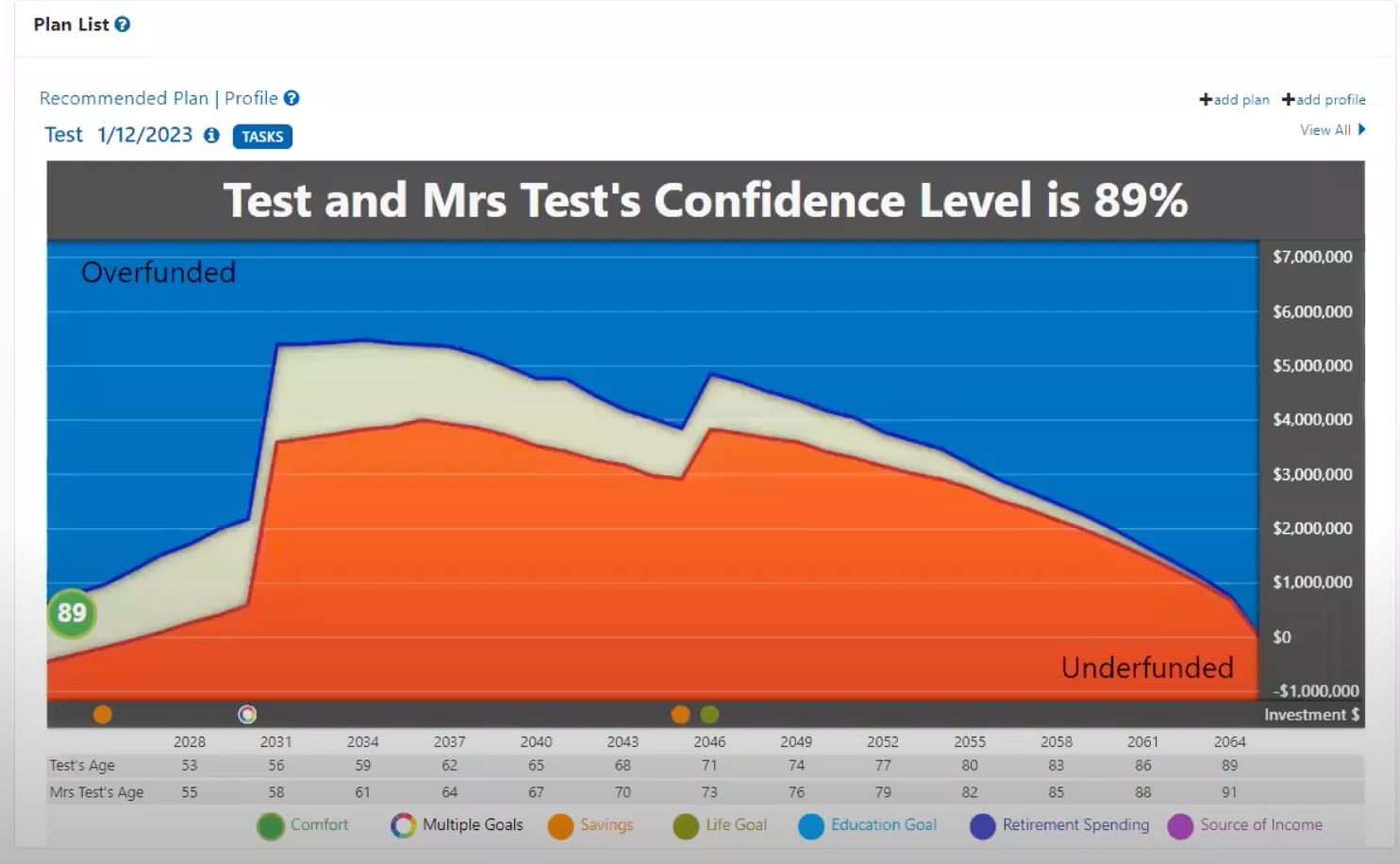

Wealthcare’s Comfort Zone Score, derived from a Monte Carlo Simulation, evaluates various scenarios to determine the likelihood of meeting financial goals. This score provides a straightforward, numerical value that quantifies financial health and planning success, ranging from 0-100. A score within the optimal range of 75-90 indicates a high probability of financial goal achievement, offering clients a clear and digestible visualization of their financial standing.

The Comfort Zone integration serves as a visual guide for advisors to effortlessly illustrate an intuitive numerical score. By incorporating this score into the CircleBlack Investor Dashboard, advisors can readily communicate a client’s financial standing and potential future scenarios, making financial planning sessions more productive and reassuring.

Updated in April 2024, Firm Managers can now set the Comfort Zone Score as part of their default CircleBlack Investor Dashboard view, enhancing visibility and accessibility. This enhanced integration ensures that both advisors and clients can immediately assess financial standing at every interaction, simplifying discussions and boosting client confidence. This not only saves valuable time during consultations but also significantly boosts client satisfaction by clarifying financial projections and the actionable steps needed to achieve their goals.

Using Wealthcare’s Comfort Zone Score to Engage and Empower Your Clients

In practical terms, the integration proves instrumental during client meetings, especially during annual reviews or strategy sessions. Let’s explore how an advisor can present the client’s Comfort Zone Score with CircleBlack’s dashboard, illustrating their current financial trajectory and how it aligns with their retirement objectives.

Imagine a typical scenario where a wealth advisor is meeting with a long-term client for their annual review meeting. The client is concerned about whether they’re on track to retire at 65 with a comfortable lifestyle. Using CircleBlack’s Investor Dashboard, the advisor can immediately show the client their Comfort Zone Score, which currently stands at 89. This score falls within the optimal range (75-90), indicating a high level of probability for success. With both of them laying eyes on this unambiguous score, the advisor can advise the client that there is sufficient confidence in this portfolio strategy achieving its desired goals.

This scenario highlights how the score provides a foundation for discussions on potential market impacts and investment strategy adjustments, empowering clients to make informed decisions.

- Client Concern: Uncertainty about meeting retirement goals

- Advisor’s Tool: CircleBlack’s updated Investor Dashboard showing the Comfort Zone Score

- Outcome: A score of 89 within the optimal range (75-90) reassures the client of the robustness of their financial plan, fostering trust and satisfaction

The advisor explains that this score is derived from a Monte Carlo Simulation, which considers various factors like age, life expectancy, retirement spending, and more, under different economic conditions. This visualization helps the advisor’s client understand the flexibility of their plan against potential market volatility, providing peace of mind and helping them make informed decisions about possible adjustments to their investment strategy.

CircleBlack’s integration with Wealthcare is designed to maximize the capabilities of both platforms, offering significant benefits for advisory firms:

- Reducing Advisor Burden: The Comfort Zone Score automates the analysis of complex variables, saving advisors time and reducing the effort required to prepare for and conduct client meetings

- Enhancing Client Understanding: By providing an intuitive visualization of financial outcomes, the Comfort Zone Score helps clients grasp intricate financial concepts and understand their current standing at a glance

- Empowering Clients to Act: This clarity not only satisfies clients but also empowers them to take informed actions toward their financial goals, further supported by their advisor’s expertise

Elevate your practice with CircleBlack’s integration with Wealthcare, leveraging the Comfort Zone Score to transform how you engage with clients. Reduce your workload, enhance client satisfaction, and drive profitability through streamlined and intuitive financial planning.