CircleBlack’s integration with StratiFi brings powerful, PRISM-based risk scoring and analysis directly into the CircleBlack Advisor Portal. By connecting StratiFi’s risk management insights with the client and account data contained in CircleBlack’s portfolio management system, Advisors gain a streamlined view of risk tolerance and portfolio suitability — alongside all of their other performance and financial planning tools.

Overview: What is StratiFi?

StratiFi is a risk management platform that provides a one-stop solution for portfolio risk analysis, client risk profiling, and compliance so Firms can manage the right risks that are essential for their success. With StratiFi, Advisors can easily import their Clients' investment portfolios and gain a comprehensive understanding of their Clients' investments and risk.

Risk analysis solutions from StratiFi are used by Financial Advisors and Compliance Officers. Advisors use StratiFi to educate Clients; Firm Compliance uses StratiFi to monitor risk and reduce liability.

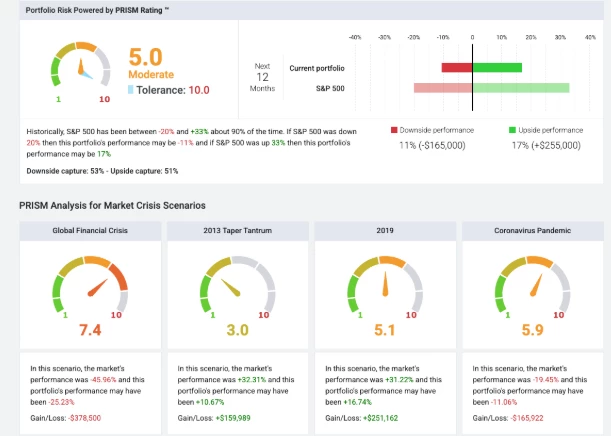

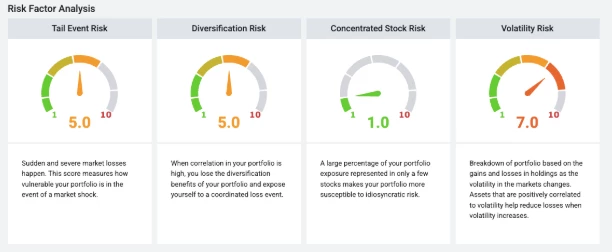

StratiFi evaluates investment portfolios using a proprietary PRISM Rating system to measure multiple risk factors, helping advisors align portfolios with their Clients’ actual risk tolerance. PRISM, StratiFi’s Portfolio Risk Inspection SysteM, is a framework for assessing risks, ensuring action is taken to mitigate unacceptable risks, and providing clarity on the potential impact of the risk. StratiFi outlines their proprietary PRISM Risk Scoring framework further in their Knowledge Base.

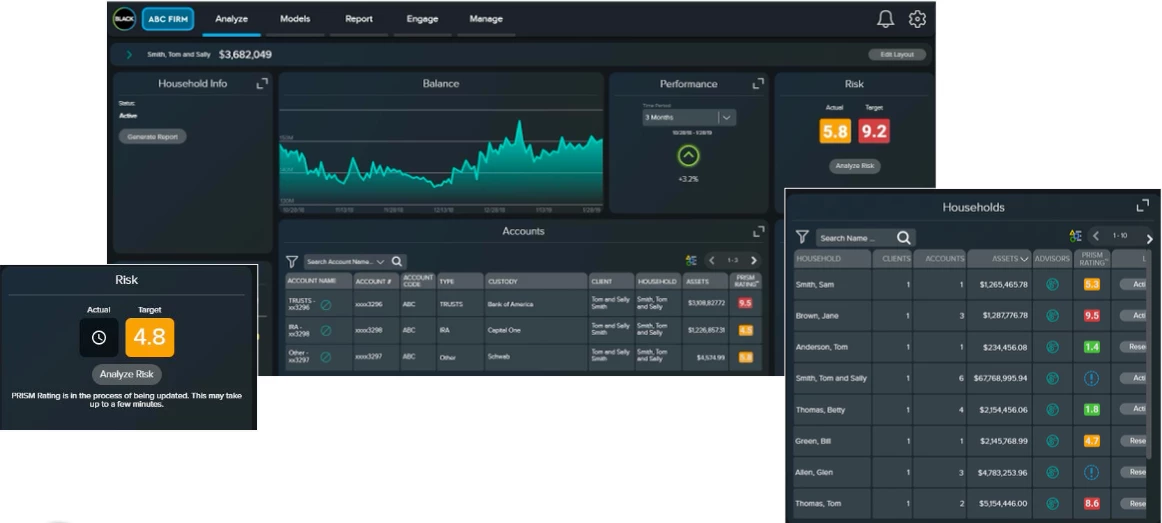

CircleBlack’s integration allows Advisors to seamlessly sync account data with StratiFi and receive StratiFi PRISM Ratings directly within the CircleBlack Advisor Dashboard, enabling more holistic conversations with Clients around risk exposure and portfolio alignment.

How Can Firms Integrate StratiFi with CircleBlack?

To successfully enable and use the StratiFi integration adapter within CircleBlack, the following conditions must be met:

- StratiFi Account Required: Advisors/Firms must have or obtain an active StratiFi advisor account

- Single Risk Partner Policy: CircleBlack users can only integrate one risk partner at a time. If another risk tool is already active (e.g., Nitrogen), CircleBlack users will need to disable it before setting up StratiFi

- Client Setup Requirements:

- Each account to be analyzed must be assigned to a Client

- Each Client must have a valid, saved email address in CircleBlack

How to Set Up and Use the CircleBlack-StratiFi Integration

Once prerequisites are met, follow these steps to activate and work with the StratiFi integration in CircleBlack:

1. Link Your Accounts

- Navigate to the Settings → Integrations page in CircleBlack

- Enter StratiFi credentials to link your CircleBlack account with StratiFi

Once connected, you’ll gain access to the StratiFi iFrame, which can also be accessed from the Analyze → Risk menu.

2. Syncing Households, Groups, and Accounts

CircleBlack allows syncing of the following entities with StratiFi:

- Households

- Account Groups

- Accounts (automatically included when syncing Households or Groups)

To manually initiate a sync:

- Navigate to a Household or Account Group in CircleBlack

- Click the Analyze Risk button to initiate the sync

- This button is not available for individual Accounts

- All associated Clients and Accounts will be created in StratiFi

StratiFi will then calculate the PRISM Rating and return that score to CircleBlack, where it will be displayed in the Advisor Dashboard.

3. Viewing and Managing Risk Scores

Once synced:

- PRISM Ratings and Risk Tolerance Scores are visible directly within the CircleBlack platform

- Clicking on either score launches a contextual Single Sign-On (SSO) iFrame with detailed analysis from StratiFi

- These scores provide a clear understanding of how closely Client portfolios align with their risk preferences

Additionally, Advisors can manage and update Risk Tolerance scores from right within the StratiFi iFrame environment.

4. Weekly Sync

A weekly automated recalculation ensures:

- Updated PRISM Ratings

- Updated Risk Tolerance Scores

- Alignment with any changes in client accounts or portfolio structure

No manual intervention is required for the weekly update, though Advisors can initiate on-demand syncing for Households or Groups as needed.

The CircleBlack and StratiFi integration empowers Advisors and Compliance users with automated risk analysis and PRISM-based insights, helping them better understand and communicate portfolio risk across Client accounts. By linking accounts for these two powerful wealth management technology solutions, Firms can effortlessly include risk scoring into their advisory process — enhancing their ability to deliver compliant, personalized, and insight-driven advice.

To learn more about StratiFi, visit their website or their Knowledge Base.