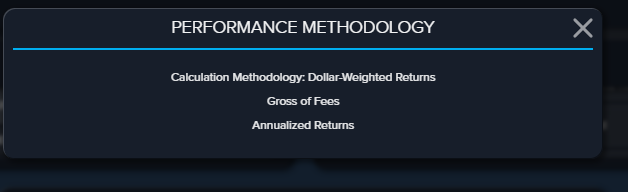

Performance Methodology

When calculating your investment performance, by default CircleBlack uses a “dollar-weighted return” (sometimes called a “money-weighted return”) methodology. This methodology seeks to reflect the actual gains or losses you’ve gotten from your investments by weighting times when you had more money invested more heavily than times when you had less money invested. This methodology is in contrast to a “time-weighted return” methodology which weights every time period equally.

Notes: Firms and advisors have the ability to change the calculation methodology to Time Weighted in Advisor Preferences and Household Preferences.

The calculation methodology being used can be viewed within the Advisor and Investor Portals for performance and holding tiles by selecting the information indicator.

Transaction Handling

The dollar-weighted performance numbers presented in CircleBlack are not simply the percentage change in the market value of your holdings; they incorporate the effect of transactions that can change the value of your holdings but don’t affect investment performance. For example, withdrawing money from an account decreases the account’s value, but its investment performance isn’t affected.

The same is true of dividends paid to a company’s shareholders, which reduce the market value of a company’s stock but shouldn’t be considered to have adversely affected the stock’s performance. By incorporating the effects of these types of transactions, CircleBlack properly represents your actual investment performance.

Calculation Example

The following (very simplified) example shows the effects of transactions and the difference between dollar-weighted returns and time-weighted returns. Let’s say you start with $1,000 in an account. On the first day, you lose 5% so you end the day with $950. You then add an additional $1,000 to your account, so you have $1,950. On the second day, you gain 4% so at the end of that day you have $2,028. You invested a total of $2,000 and ended up with $2,028, so you have a gain of $28.

A time-weighted return methodology would treat your performance during each day equally. Since you lost 5% on one day and gained only 4% on the second day, your time-weighted return is -1.2%. This negative performance is not consistent with the fact that you actually made money from your investments.

By contrast, a dollar-weighted return methodology (which is the one that CircleBlack uses) weighs the performance on the second day more heavily than the performance on the first day since you had more money invested on the second day. The dollar-weighted return in this example is approximately +1.9%, which is consistent with the fact that you gained $28.

Reporting Levels

CircleBlack presents your performance at the portfolio level (all of your accounts together), the account level, and for each individual investment you own. If you have multiple holdings of the exact same investment in an account or portfolio (for example, you have 2 different accounts that contain the same fund), CircleBlack shows the combined performance of all holdings of that investment.

Performance Contribution

In addition to the dollar-weighted return of your investments, CircleBlack also shows how much your investments contributed to the overall performance of your portfolio and accounts. The top-performing investment in your portfolio, for example, may not have had much of an impact on your overall performance if it’s one of your smaller holdings. The performance contribution numbers allow you to better grasp how much various investments helped or hurt your overall performance during a given time period.

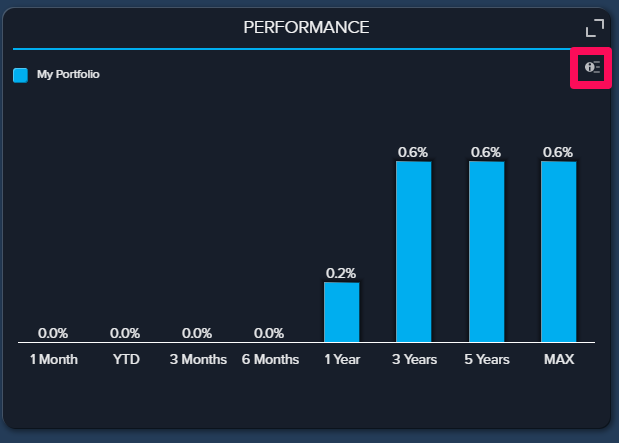

Time Periods

CircleBlack calculates your performance for all of the following time periods for which there are sufficient data: the past week, the past month, the past 3 months, the past 6 months, the past year, the past 3 years, the past 5 years, the past 10 years, and year-to-date (i.e. since the beginning of the current calendar year). The longer you are a CircleBlack client, the more time periods will be presented. The performance numbers for all time periods longer than 1 year are presented as annualized returns so that they are more easily comparable across different time periods.

Data Quality

CircleBlack does extensive data cleanup to normalize financial data from thousands of different financial institutions and allow for accurate performance calculations. There are also procedures in place to minimize the impact of any temporary connection issues with your financial institutions. Connection issues that are not resolved quickly, however, have the potential to degrade the quality of the performance data. If there are ever connection issues that you can take action to resolve, Client Services will reach out to you to help ensure that the performance numbers you see on CircleBlack remain as accurate as possible.