CircleBlack offers a deep, bidirectional integration with MoneyGuide (MoneyGuidePro), a leading financial and retirement planning platform. This integration enables Advisors to deliver customized, goal-based planning services by linking Client data, streamlining financial planning, and enhancing both Advisor and Investor (Client) experiences through secure, intuitive access.

What is MoneyGuide (MoneyGuidePro)?

MoneyGuide (MoneyGuidePro) is a leading web-based financial planning software designed for Financial Advisors to create personalized, goal-based financial plans for their Clients. Developed by Envestnet, this interactive financial planning solution offers a comprehensive suite of tools that can be leveraged by Advisors using CircleBlack through an integration adapter that enables a robust, bidirectional transfer of data.

Key Benefits of the MoneyGuide Integration with CircleBlack

The CircleBlack-MoneyGuide integration brings powerful planning functionality directly into the CircleBlack platform:

- Single Sign-On (SSO): Launch MoneyGuide directly from CircleBlack without separate credentials

- Data Synchronization: CircleBlack sends Client and account data to MoneyGuide to facilitate planning

- Probability of Success (PoS): MoneyGuide returns each household’s PoS score into CircleBlack

- Document Sharing: Financial plans created in MoneyGuide are shared back to CircleBlack for Advisor and Client access

MoneyGuide Setup Process for Advisors Using CircleBlack

Before enabling MoneyGuide access within CircleBlack, a brief configuration process is required:

1. Identify Users

Advisors/Firms needs to determine which users (Advisors) will access MoneyGuide through CircleBlack.

2. Provide Firm Details

The MoneyGuide Admin User must supply the following information to the CircleBlack Customer Success Team (help@circleblack.com):

- Company Name:

- Go to MoneyGuide → Main Menu → User Options → User Profile → Company Name

- Institution ID:

- Go to MoneyGuide → Main Menu → Admin Box → User Options → Partner Options → Institution ID

Once submitted, CircleBlack will confirm once that the MoneyGuide integration is activated and ready for use.

How to Access MoneyGuide from CircleBlack

CircleBlack provides multiple, intuitive access points to MoneyGuide throughout the CircleBlack Advisor Portal. Advisors can launch MoneyGuide and manage plan connections using any of the following methods:

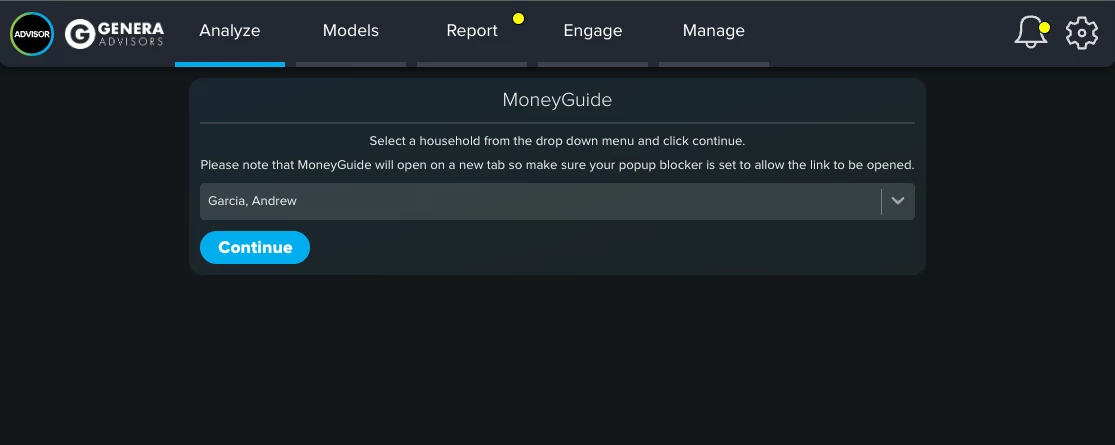

- Analyze Tab → Financial Planning:

- Select the household to access or link

- Analyze Tab → My Portfolio (Firm View):

- Expand the Households tile → Click the PoS meter icon next to the household

- Analyze Tab → Households Tile:

- Search and select a household → Open the Household Dashboard → Click the PoS meter

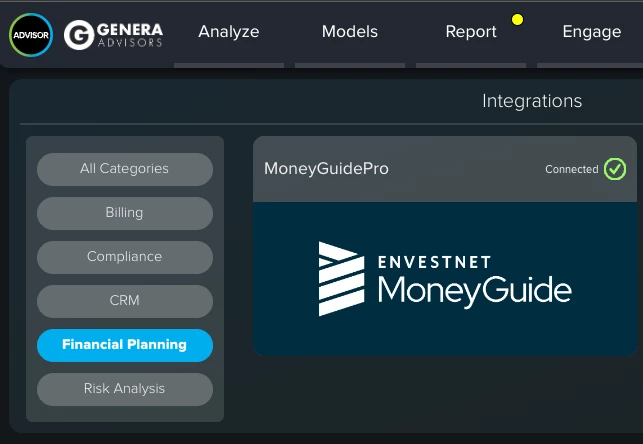

- Settings → Integrations:

- Click the MoneyGuide logo to open the integration settings

How to Link Clients in CircleBlack to Existing MoneyGuide Client Accounts

If the Client already exists in MoneyGuide, Advisors can easily link them to a corresponding household in CircleBlack:

- Navigate to the household using one of the methods listed above.

- SSO into MoneyGuide from the CircleBlack interface.

- On the "Link to Client in MoneyGuidePro" page:

- Enter the client’s last name to search

- Or click Search to see all existing MoneyGuide clients

- Select the appropriate client and follow the prompts to complete the linkage.

How to Create a MoneyGuide Client from CircleBlack

If the client does not yet exist in MoneyGuide, CircleBlack will push Client, household, and account data directly into MoneyGuide to create a new Client record. This ensures data consistency and enables Advisors to begin planning immediately.

How to Configure MoneyGuide Access for Advisors in CircleBlack

Before granting Clients access, Advisors can configure settings within MoneyGuide:

- Access Permission: Allow or deny Investor Portal access

- Discovery Templates: Choose data-gathering templates tailored to Client needs

- Plan Sharing Options: Share snapshot views or full planning documents

- Landing Page Display: Choose the default landing screen for each Client’s Investor Portal

Overview of MoneyGuide Discovery Templates for Clients

MoneyGuide includes several built-in templates for collecting financial data from Clients, each suited for different planning stages:

| Template | Description | Time to Complete |

|---|---|---|

| Discovery A | Designed for prospects, captures basic personal and retirement data | < 30 mins |

| Discovery B | For standard clients, collects detailed financial data | 30–60 mins |

| Discovery C | For HNW clients, gathers advanced data for stress testing and deeper analysis | 30–75 mins |

| Discovery Lab | Guided, video-enhanced planning experience with client-directed planning tools | ~45 mins |

| Budget Only | Provides access to budgeting tools and financial calculators | N/A |

| Snapshot | Results-focused, shows plans, interactive tools, net worth tracking, and PoS | N/A |

| Share Plan(s) | Fully customizable template for data gathering and plan sharing | N/A |

How To Configure MoneyGuide Visibility for CircleBlack Investor Experience

Once a Client is connected, Advisors can manage their MoneyGuide visibility from the Household Preferences page in CircleBlack:

- Navigate to the Household Info tile on the CircleBlack Advisor Dashboard

- Access Household Preferences

- Check the MoneyGuide Pro box to display the MoneyGuide tile in the client’s CircleBlack Investor Portal

MoneyGuide Tile in the CircleBlack Investor Portal

Clients will see one of three states based on advisor configuration:

- SSO Only: Clients can launch into MoneyGuide but do not see the PoS score

- PoS Score Only: Clients can view their PoS but do not have direct access to MoneyGuide

- SSO + PoS Score: Clients can view their Probability of Success and launch directly into MoneyGuide

If access is not granted, the tile will appear inactive with a message indicating restricted access.

CircleBlack’s integration with MoneyGuide streamlines financial planning by combining data-driven workflows with interactive tools, enhancing advisor productivity and delivering high-value insights to clients. Whether linking existing MoneyGuide clients or creating new ones, advisors can manage everything within a single platform—reducing friction, saving time, and elevating the overall client experience.