CircleBlack is excited to announce a significant update to our mobile app, bringing upgrades and new features that achieve broad feature parity with our web version, including comprehensive enhancements to our Document Vault. These upgrades streamline workflows, enhance client harmonization, and improve the overall user experience for Registered Investment Advisors (RIAs) and their clients. These enhancements elevate client experiences and foster greater management and growth for RIAs and their advisory practices.

The Challenge for Client-Focused Advisors

RIAs often face challenges with efficient document management, seamless sharing of static and multimedia content, and organizing various document types. Financial advisors understand as well as anyone that, when acquiring and retaining clients, managing a portfolio pales in comparison to managing a client and presenting a professional, digestible client experience – and being able to deliver this at scale.

Today’s wealth managers need their wealth management technology solutions to be adept at managing and sharing diverse document types, facilitating greater client harmonization, and efficiently accessing financial data while on the go. These hurdles can lead to reduced productivity, poor client engagement, and heightened privacy concerns when accessing sensitive information in public.

Client Retention Increases with Mobile App Use

With technological advancements come advancements in opportunity. According to a 2023 report by Deloitte, firms with highly rated mobile apps saw a 30% increase in client acquisition compared to firms with less intuitive app designs. The report notes that a seamless user experience helps attract new clients who value modern digital interfaces.

That opportunity becomes more acute when attempting to attract and retain younger investors. The Deloitte report also found that 78% of Gen Y (Millennials) and 85% of Gen Z prefer using digital platforms and mobile apps for managing their finances.

“These new entrants to the world of investing are reshaping investment practices, products, and platforms, said Paul Andrews, Managing Director for Research, Advocacy and Standards at the CFA Institute, when speaking on the results of a 2023 survey conducted by the Financial Industry Regulatory Authority (FINRA).

The FINRA survey similarly found that 75% of Millennial investors prefer managing their financial portfolios through mobile apps rather than traditional methods. FINRA expects this trend to grow as Gen Z continues its foray into wealth markets.

“The Gen Z population is diverse and digitally savvy. They are using mobile technology to enter the financial markets in unprecedented numbers and consulting a wide range of information sources as they do so,” said FINRA Foundation President Gerri Walsh.

Added Andrews, “Our study has underlined the extent to which their investment habits differ significantly from their predecessor investor cohorts.”

A 2023 J.D. Power study found that wealth management apps have become the gateway to client satisfaction and retention across all generations. According to their press release, “It’s not just Millennials and Gen Z with do-it-yourself brokerage accounts driving the trend toward increased use of digital wealth management tools; the digital channel has become central to the client experience for all types of investors, with mobile apps leading the way.”

This study found that apps outperform websites in client satisfaction metrics (11 points higher on a 1,000-point scale) and that overall satisfaction improves in lockstep with digital utilization (97 points higher among those who use the mobile app regularly), underscoring the need for a robust mobile experience that your clients adopt and use on a regular basis.

Provide The Same, Complete Advisor-Client Experience on Mobile

With this update, CircleBlack’s mobile app achieves broad feature parity with the web version, introducing significant enhancements to the Document Vault and offering robust new features alongside a streamlined mobile workflow. This set of enhancements is responsive to advisor and client expectations, adding in new delighters and ensuring privacy while accessing financial information on the go.

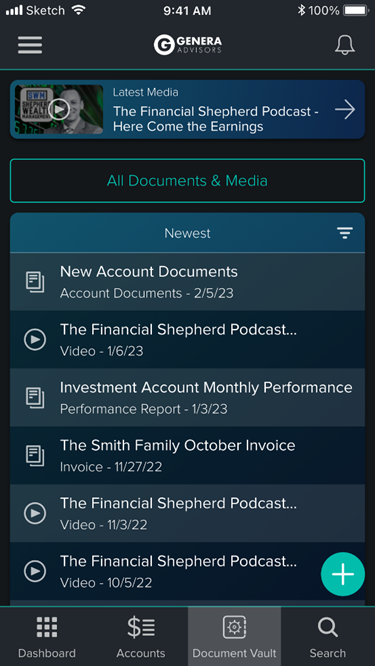

Among the delighters, the mobile app now supports the upload and consumption of multimedia files, such as videos and podcasts, directly within the platform. Users can also upload and download documents bidirectionally, create and manage folders, sort documents by name or date, and share files on and off the platform.

New features within CircleBlack’s wealth management mobile app include:

Document Vault Enhancements

CircleBlack has enhanced our Document Vault with a focus on improving and expanding the advisor-client relationship. New capabilities in the Document Vault upgrade document management as well as document interactions.

Most consequentially, the CircleBlack Document Vault now supports multimedia on both mobile and web platforms. This allows advisors to share their audio and video podcasts or other newsworthy rich media files with all or a specific individual or subset of clients.

Document Management

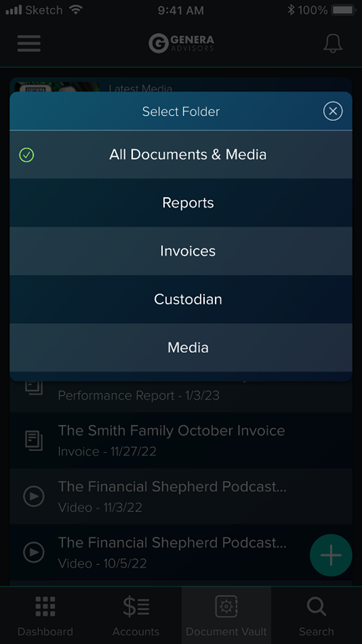

- Enhanced Folder Organization: Advisors can categorize and organize document types with a new Document Vault user interface, making it easier to locate specific documents.

- Edit Document Details Modal: Easily edit document names, types, and tags through a redesigned preview modal.

- Notification Icons: Enhanced notification icons ensure important updates are easily noticed. Furthermore, clicking on a Notification Icon will direct the user to a preview of the document within the Document Vault.

- Improved Document Vault Navigation: Selecting a row also now opens the document’s preview modal, initiating an abridging of the document interaction process.

Document Interactions

- Bidirectional Uploads and Downloads: Both advisors and their clients can easily upload and download documents bidirectionally, including rich media files like videos and podcasts.

- Document Sharing: Share multiple documents at once from the documents table, streamlining the sharing process. In addition to bulk document sharing, documents can now be shared on and off the platform, regardless of the document owner, facilitating easier collaboration.

- Embedded Media Player in Document Vault: Advisors and clients can access an embedded media player in the Document Vault on both mobile and web platforms, facilitating the consumption of video and audio content directly within the app.

- Multimedia Sharing & Consumption on Mobile: Users can preview, scan, and upload various file types, including presentations, spreadsheets, text files, and images.

On-The-Go Workflow & Visualization Updates

This is more than a minor part of this update: the ability for advisors and clients to have fewer taps to drill down into their desired area within the app creates a greater, more organized, and more efficient user experience. Enjoy a cleaner interface, light mode, and improved workflows for toggling key metrics and clustering balance-related widgets.

· Streamlining Workflows with Efficient Navigation: The app has been designed to significantly reduce the number of taps required to drill down into desired endpoints, making navigation intuitive and efficient.

· User-Friendly Interface: Featuring a beautiful, non-intimidating, and easy-to-navigate UI/UX, the app allows users to quickly access charts, graphs, documents, and media with minimal effort while maintaining a high level of organization and reducing screen-loading times.

· Light Mode Implementation: A new light mode option provides a visually pleasing alternative to the dark mode. Experience a new aesthetic option preferred by many users.

· Advanced Data Visualization: Time-period preferences, i.e. 3 months or 2 years, are now saved within balance graphs, transactions view, and holdings view. Previously, an advisor could set preferences to a default time-period within the portal settings and have this apply to all widgets. Now, an advisor can select their preferred time-period view separately for different widgets, i.e. transactions can be viewed over 3 months while holdings are viewed over 2 years. With each selection, that specific widget will maintain and reflect the time-period selection whenever the widget is revisited, until an advisor changes the preference.

· Clustered Balance Widgets: Balance-related drill-downs and widgets, such as exposure, risk, performance, and asset classes, are now clustered for easier access. These rich content widgets allow for a deep-dive into each category for greater introspection by account and by widget.

· Toggle Big Number Visibility for Privacy Control: Users can hide or reveal their total portfolio value with a simple click. This feature is especially beneficial for clients who can toggle the visibility of their portfolio value depending on their setting, whether they are in private or looking to check their portfolio discreetly in public settings. The visibility preference (toggled on or off) carries through to each page or view within the app, maintaining the user's most recent selection for a consistent and secure experience.

Sync on Strategy and Propel Performance

CircleBlack’s mobile app continues to put advisors and their firms at the forefront of the client experience.

In addition to the custom, polished, and professional mobile aesthetic, the CircleBlack mobile app is designed to empower RIAs with advanced tools for managing documents, delighting clients, and gaining deep financial insights—all from their mobile devices. The streamlined workflows, intuitive navigation, and beautiful UI/UX ensure that advisors and their clients can quickly and easily access their desired charts or information.

The privacy control feature, allowing users to toggle the visibility of their total portfolio value, ensures clients can check their financial status discreetly while on the go. As always, robust security protocols ensure client data privacy and compliance with financial regulations through secure document management and communication features.

These core value propositions highlight the app's ability to streamline operations, improve client service, and provide a secure, efficient, and modern platform for financial advisors on the go.

Use-Case: The OOO RIA

Before, during, and following client meetings, advisors can use the Document Vault to upload and organize documents, ensuring all necessary files are easily accessible. Clients can also preview, scan, and share documents directly from the app.

This means that an advisor preparing for a client meeting can upload the latest financial reports and categorize them under the "Reports" folder. During the meeting, both the advisor and client can quickly access these documents and review them together even without being in the same room.

Even when an advisor is traveling to a conference – or taking some well-deserved personal leisure time thanks to new-found efficiencies using CircleBlack – and a client has questions about their portfolio, the advisor can use the mobile app to review a client's portfolio performance with localized time-periods, ensuring they have up-to-date information at their fingertips.

Advisors and clients can use the enhanced data visualization tools to view detailed financial data, helping them make informed decisions. Additionally, the ability to toggle portfolio visibility is a lauded element of privacy control when accessing sensitive information in public.

The app’s streamlined workflows and improved UI/UX serve to reduce the number of taps required to access information, saving time and improving overall efficiency.

And, for the Out-of-Office RIA managing their clients at scale, bulk sharing of documents allows that advisor to distribute monthly reports to all or some subset of clients in one go, reducing administrative time and effort so they can get back to the conference – or the picnic, or the golf course, or the beach.

The updated CircleBlack mobile app represents a significant step forward in delivering a superior advisor-client experience. By integrating powerful features and enhancing usability, CircleBlack continues to support RIAs in providing exceptional service and achieving their business goals.

CircleBlack’s mobile app continues to elevate the advisor-client experience.

Revolutionize Your Financial Advisory with CircleBlack's Mobile App Update

RIAs leveraging CircleBlack understand the value of providing their clients with the mobile experience they desire. The latest update to the CircleBlack mobile app brings numerous benefits to both RIAs and their clients, enhancing efficiency, harmonization, and data management.

For RIAs:

- Enhanced Client Service & Efficiency: The ability to manage documents and access detailed financial views directly from the mobile app saves time and reduces administrative burdens. Enhanced data visualization enables advisors to provide more personalized and responsive service to their clients.

- Flexibility and Convenience: The mobile app allows advisors to stay connected and manage their business on the go, ensuring they can respond to client needs promptly.

For Clients:

- Seamless Experience: Clients benefit from the same comprehensive features available on the web version, now accessible on their mobile devices.

- Improved Document Management: Enhanced Document Vault features provide clients with easy access to their important documents, supporting better organization and accessibility.

More than half of advisors say they’ve lost prospects and 25% say they’ve lost existing clients because their wealth management technology failed to meet expectations.

This challenge turns to opportunity when seeing that only two-thirds of advisors are currently meeting the market need by providing mobile apps for their clients, but those that do see a 20-30% improvement in client engagement compared to those who rely solely on traditional methods.

Experience the transformative power of CircleBlack’s enhanced mobile app. With a professional experience, advanced Document Vault features, improved client interactions, detailed data visualization, and privacy control capabilities, our app is designed to empower advisors and enhance client service. Contact CircleBlack for a demo and discover how our latest updates can help you achieve your business goals efficiently and securely. Don’t miss out on transforming your advisory practice—take advantage of these powerful tools now.