Enhancing Client Experience through Household Preferences

In a prior update, CircleBlack allowed the customization of reports and performance metrics but faced limitations in the distribution process due to technical constraints.

With the improvements in our May 2024 release, we've enhanced the email logic to ensure that specific firms or households affected by previous distribution issues are now correctly included in weekly/monthly email report distributions. This refinement means that no client misses out on crucial financial insights due to software hiccups.

CircleBlack Household Preferences Functionality

To utilize this enhanced functionality, advisors can navigate to the Household Information Widget or the Household Information Details page, then select Preferences. These Preferences include:

- Email Reports

- Monthly & Weekly Email Reports are delivered directly to a Household’s email in HTML format with the firm or advisor logo and include the following:

- Household’s total portfolio balance & the portfolio’s change over the given time period

- Each account’s balance and the account balance change over a given time period

- The Household’s portfolio asset allocation breakdown

- If activated to the Investor portal, a login button

- The Household will receive these reports if the checkbox is selected

- Monthly & Weekly Email Reports are delivered directly to a Household’s email in HTML format with the firm or advisor logo and include the following:

- Performance Calculation Methodology

- Set at the firm level, calculation of performance and type are displayed in the Investor portal

- Includes:

- Methodology: Time-Weighted Return or Dollar-Weighted Return

- Type: Net of Fees or Gross of Fees

- Benchmark

- Gives Advisors the ability to determine which benchmark is shown to clients in the Investor portal’s performance tile. Advisors can also select a preferred default benchmark. The default benchmark shown is None. The following ETF-based benchmarks are available:

- Equity:

- ACWI Global Stocks

- ACWX All Countries Ex US

- DIA Dow Jones Industrials

- VWO Emerging Markets

- QQQ NASDAQ 100

- IWM Russell 2000

- IJH S&P Mid Cap

- SPY S&P 500

- VTI Total US Stocks

- Fixed Income:

- VCIT Intermediate Term Corporate Bonds

- HYG High Yield Bonds

- BNDX International Bonds

- BND Total Bond Market

- MUB Municipal Bonds

- Equity:

- Once the preferences are set, clients will be able to view the changes upon their next login.

- Gives Advisors the ability to determine which benchmark is shown to clients in the Investor portal’s performance tile. Advisors can also select a preferred default benchmark. The default benchmark shown is None. The following ETF-based benchmarks are available:

In the Household Information Widget or the Household Information Details page, Preferences can be used to customize the reporting features for one or multiple households.

View & Edit Clients within an Associated Household

Beginning with a June 2024 release, a table in the Advisor Dashboard gives advisors the ability to easily view all clients associated with a Household grouping from the Household Dashboard, including the Client Name, Relationship, and Total Assets. All of the columns are sortable. This update also enables advisors to quickly edit information related to their clients.

Read more about enhancing your client management with CircleBlack’s Household Grouping feature here.

Apply Household Preferences to Multiple Households

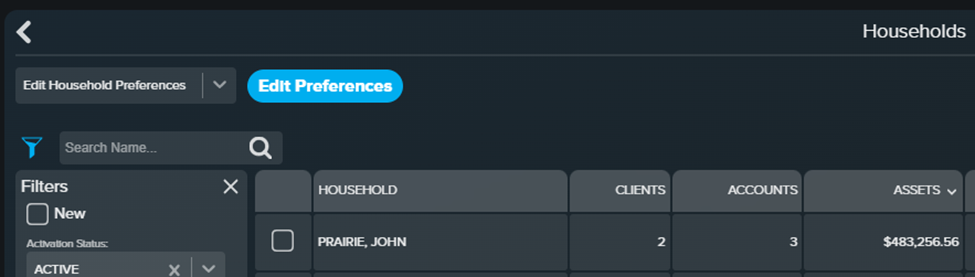

- From the Manage > Households Page, advisors will be able to view the new Edit Household Preferences action if they are entitled to update Household Preferences.

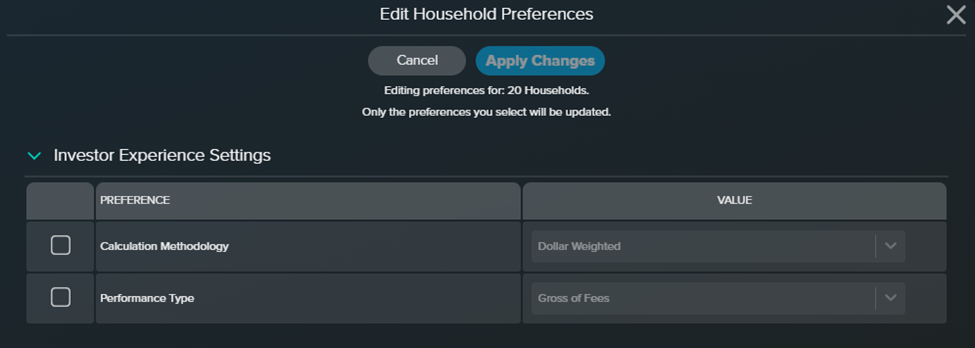

- After selecting the households to be updated, select Edit Preferences to be prompted with a window for choosing the preferences to be updated.

Check the preferences you are applying and the associated value. From there, you can select Apply Changes which will apply the selected preferences to each household selected.

In a practical scenario, advisors can choose to send out monthly email reports that include detailed account balances, portfolio changes, and asset allocation breakdowns, all branded with the firm’s logo. This can significantly improve engagement by keeping clients well-informed about their investments and any changes over time